Transforming Productivity Metrics: From Realization Rate to Revenue Factor

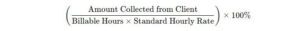

Early in my career, I worked at a CPA firm that relied heavily on a performance metric called the realization rate. This metric is calculated as:

Alternatively, when focusing on collections, it’s calculated as:

Since most work was billed hourly at designated rates, the realization rate provided a clear picture. The only factor that could drop the realization rate below 100% was client discounts, which were rare. More often, the realization rate exceeded 100% because salaried employees frequently logged over 40 billable hours weekly (and were often rewarded for it). The firm used the aggregate realization rate to project revenue and gross profit with a high degree of accuracy.

AE Industry Meets Realization Rate

After leaving the CPA firm, I joined a small architecture firm as a controller and encountered a different scenario. The firm was unfamiliar with the realization rate and primarily used negotiated lump-sum contracts. They focused on the utilization rate of each employee, but I had already observed the pitfalls of overemphasizing the utilization rate in AE firms.

Like many AE firms operating under lump-sum contracts, my new employers were frustrated that high utilization rates didn’t necessarily translate to additional revenue. They needed a better metric to link staff productivity to firm profits. I proposed tracking each employee’s realization rate instead.

They had not heard of the realization rate metric, and many of their contracts were based on negotiated lump sums. They were focused on each employee’s utilization rate.

The logic was simple: under lump-sum contracts, dividing the amount billed monthly by the billable hours recorded provided an hourly rate for each project. With most employees salaried, we calculated their hourly cost by dividing their salary by 2080 hours, allowing us to generate a gross margin for each team. Fewer hours worked meant a better realized rate because the revenue was not dependent on the hours worked.

As expected, the firm’s utilization rate plummeted. The teams with the highest realization rates were praised and rewarded, even though they felt like they weren’t working as hard as they used to. However, bonuses didn’t increase much since overall revenue remained stagnant while payroll and overhead costs rose.

The Push for Higher Utilization

One principal noted the number of nonbillable hours recorded that year and suggested that the firm increase profits by selling more projects and keeping the staff busier. While focusing on the realization rate didn’t directly improve profitability, it did increase the firm’s capacity.

In response, we ramped up marketing efforts, securing new clients and projects the following year. However, in their zeal to win more work, the principals reduced the lump-sum fees for these new clients, lowering the realization rate while maintaining high utilization.

Consequently, the firm broke even that year, and any extra funds that could have been bonuses were spent on increased marketing. We even lost a couple of valuable PMs to a competitor willing to pay more. The firm’s realized rate was very strong, but the 20% increase in revenue came from almost all lower-fee projects, which lost money.

Shifting to the Revenue Factor

Realizing my traditional financial education was not helping, I took several AE industry-specific courses on financial management. I learned about the AE firm’s revenue factor or payroll multiplier calculated as:

When this metric, typically between 1.5 and 2.2, was introduced at my firm as the “metric du jour,” it was met with skepticism.

However, it soon proved effective because nobody could use their timesheet to manipulate their revenue factor. More direct hours drove the realization rate down by an almost equal amount, so the revenue factor was constant.

PMs and principals quickly realized that completing lump-sum projects under budget positively impacted the revenue factor and project profits. They also learned that a higher revenue factor was often set when the project was sold, not completed. So, the firm gradually moved away from all the clients who demanded low fees.

The marketing strategy shifted to seeking high-value clients instead of just chasing revenue. Within two years of tracking the revenue factor, the firm was 20% smaller but 60% more profitable. Instead of trying to “game the system” to achieve higher utilization or realization, employees focused on getting work done efficiently and accurately.

Next Steps

Transforming your business doesn’t have to be painful or overwhelming. Following a few straightforward steps can improve your AE firm’s performance and achieve greater success. The strategy is simple:

- Train your PMs to expertly manage projects and teams.

- Seek out clients willing to pay a fair lump-sum fee for your work.

- Incentivize project teams to maximize their revenue factor.

- Monitor and control overhead expenses closely.

This approach has consistently yielded remarkable results, enhancing productivity and profitability across the board. If you want to achieve similar results, let’s discuss how this strategy can work for your firm.