Government Contract Advisory

Government contract success requires strong management skills.

SN’s advisory services raises the bar on how architecture, engineering and construction firms can maximize the benefits of government contracting projects. We’ve built a team of specialists who work solely with AEC government contractors, providing financial acumen and unique understanding of the intricacies and challenges inherent in navigating the Federal Acquisition Regulations (FAR) and Cost Accounting Standards (CAS).

Navigating government contracts can be complex, but with our state and federal contract management and accounting experience, you’ll confidently prepare for audits, improve management reporting, and position your business for growth and profitability.

GovCon Expertise for Sustainable Growth

Who can benefit from SN’s government contract advisory services? If you are a small architecture, engineering, or construction firm performing state or federal government contracts with a focus on DOT and transportation contracts and are experiencing any of the following challenges, we can be of assistance:

- Outgrowing internal staff or CPA capabilities

- Managing administrative burdens and employee turnover

- Preparing for first-time audits

- Resolving audit issues

- Addressing software struggles or pricing and profitability concerns

- Scaling for growth or planning an exit strategy

Drive Financial Success with CFO-Level Insights

We help firms craft a clear vision for their financial future. Whether you’re optimizing performance, managing financial risks, or adopting new technologies, our CFO Advisory Services are laser-focused on positioning your business for long-term success. While controllers manage where you’ve been, CFOs guide where you’re going. With our expert guidance, you’ll work on your business, not in it, equipping your firm to meet challenges head-on and achieve sustainable growth.

- GAAP compliance

- FAR readiness assessment

- ICQ evaluation

- Software transition

- Budgeting & forecasting

- Proposal & pricing support

- Indirect rate strategy

- Policies & procedures

- Audit preparation & remediation

- Quality of earnings, valuation, M&A support

Protect your AE firm from costly fines and penalties.

Our expert-led, on-demand training series, Government Accounting Compliance for Small AE Firms, teaches you how to navigate complex government accounting regulations and ensure compliance.

Preview our 7-course training for free today, and gain the knowledge and skills you need to succeed in government contracting.

- Government Accounting Compliance Laws & Regulations

- Overall Accounting System Design

- Direct vs. Indirect Costs

- Cost Under General Ledger Control

- Timekeeping Systems

- Labor Distribution

- Final Application & Best Practices

GovCon Expertise for Sustainable Growth

Who can benefit from SN’s government contract advisory services? If you are a small architecture, engineering, or construction firm performing state or federal government contracts with a focus on DOT and transportation contracts and are experiencing any of the following challenges, we can be of assistance:

- Outgrowing internal staff or CPA capabilities

- Managing administrative burdens and employee turnover

- Preparing for first-time audits

- Resolving audit issues

- Addressing software struggles or pricing and profitability concerns

- Scaling for growth or planning an exit strategy

Drive Financial Success with CFO-Level Insights

We help firms craft a clear vision for their financial future. Whether you’re optimizing performance, managing financial risks, or adopting new technologies, our CFO Advisory Services are laser-focused on positioning your business for long-term success. While controllers manage where you’ve been, CFOs guide where you’re going. With our expert guidance, you’ll work on your business, not in it, equipping your firm to meet challenges head-on and achieve sustainable growth.

- GAAP compliance

- FAR readiness assessment

- ICQ evaluation

- Software transition

- Budgeting & forecasting

- Proposal & pricing support

- Indirect rate strategy

- Policies & procedures

- Audit preparation & remediation

- Quality of earnings, valuation, M&A support

Protect your AE firm from costly fines and penalties.

Our expert-led, on-demand training series, Government Accounting Compliance for Small AE Firms, teaches you how to navigate complex government accounting regulations and ensure compliance.

Preview our 7-course training for free today, and gain the knowledge and skills you need to succeed in government contracting.

- Government Accounting Compliance Laws & Regulations

- Overall Accounting System Design

- Direct vs. Indirect Costs

- Cost Under General Ledger Control

- Timekeeping Systems

- Labor Distribution

- Final Application & Best Practices

“…an experienced accountant is the most important professional for a government contractor.”

“As a government contracts lawyer, I hate to admit it, but to me, an experienced accountant is the most important professional for a government contractor. Robert is my go-to accountant when my clients bring me an issue involving government accounting, cost principles, audits, etc. He’s very good!”

Terry O’Connor

Partner

Berenzweig Leonard

The Clock is Ticking: Don’t Let CMMC Non-Compliance Impact Your GovCon Accounting

Act now to protect your financial stability – read our urgent CMMC guide.

SBA Final Rule: Reshaping GovCon M&A in 2025

Understand the key changes, valuation impacts, and why acting now is crucial for small government contractors

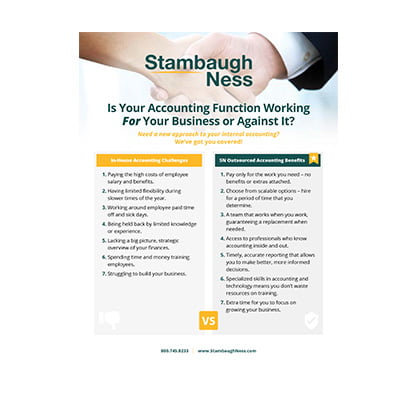

A New Approach to Internal Accounting

This infographic helps you determine if outsourced accounting services is the right fit for your business.